To handle medical expenses after a car accident in Las Vegas, use your MedPay coverage, submit bills through health insurance, seek care on a medical lien, and file a personal injury claim against the at-fault party. Medical expenses typically include emergency care, hospitalization, surgery, prescriptions, and long-term rehabilitation.

The average hospital bill after a car accident in Las Vegas ranges from $3,500 to over $62,000, depending on injury severity. The average cost for a non-surgical ER visit is approximately $3,200, while extended inpatient stays exceed $12,500 (Nevada Department of Health and Human Services).

Retaining competent and qualified legal representation for your car accident case has been shown to increase compensation for medical expenses, reduce medical debt, and assist with negotiating bills. The chances of victims facing out-of-pocket expenses, receiving notice of denied claims, or being forced to accept lowball settlements increase without having a lawyer advocating for their side. Based in Las Vegas, Ace Law Group has helped local clients recover over $1 million in auto accident cases involving high medical costs, including a $7.1 million recovery for a traumatic brain injury after a Las Vegas vehicle and pedestrian accident.

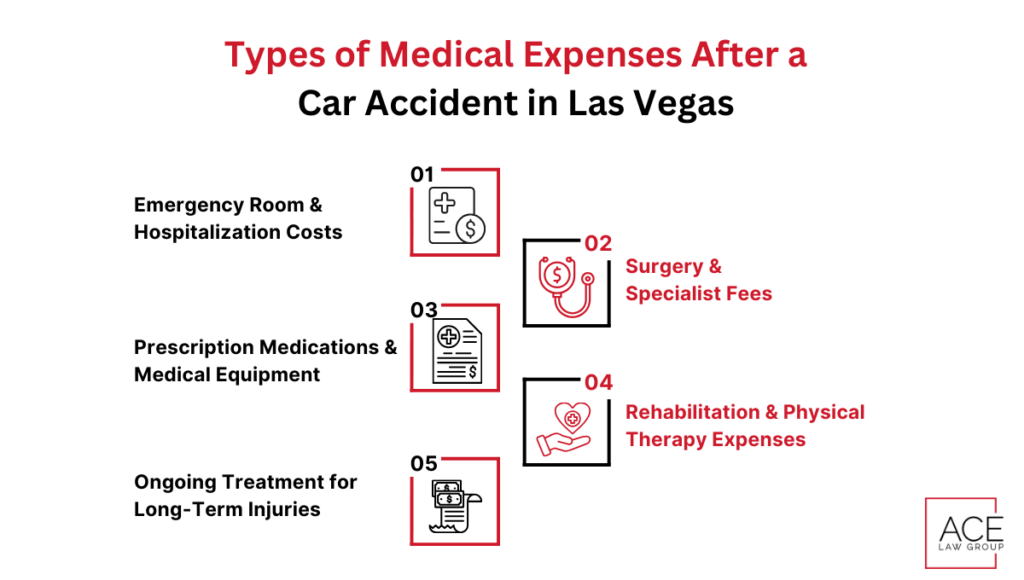

What Types of Medical Expenses Can You Face After a Car Accident in Las Vegas?

After a car accident, medical bills can add up quickly, even if your injuries seem minor at first. Here are five common types of medical expenses you may encounter following a crash in Las Vegas:

- Emergency room & hospitalization costs

- Surgery & specialist fees

- Prescription medications & medical equipment

- Rehabilitation & physical therapy expenses

- Ongoing treatment for long-term injuries

1. Emergency Room & Hospitalization Costs

Emergency care is often the first major expense. In Las Vegas, Summerlin, Henderson, and surrounding cities, average emergency room visits cost between $3,000 and $8,000, and average hospital stays may reach $10,000 to $30,000 or more, depending on injury type, trauma level, and facility used.

Hospitals calculate costs based on treatment intensity, use of specialists, diagnostic imaging, and overnight care. According to Nevada Health Link, even short ER visits carry a hefty out-of-pocket burden without proper insurance or MedPay coverage. Trauma centers like UMC Trauma Center in Las Vegas or St. Rose Dominican Siena in Henderson charge more due to advanced care services.

2. Surgery & Specialist Fees

A surgical intervention is necessary if the accident caused internal injuries, broken bones, or spinal trauma. A single surgery costs between $20,000-$50,000, or even more if additional pre-op or post-op complications are found.

Common post-accident surgeries include orthopedic repairs, back surgeries, and neurological operations. These often involve separate charges for anesthesia, surgeons, and specialists.

Specialist consultations (e.g., neurologists, orthopedic surgeons) typically run $250–$500 per visit and are required multiple times during recovery.

3. Prescription Medications & Medical Equipment

Accident victims often need painkillers, anti-inflammatories, muscle relaxants, or antibiotics during recovery. While insurance covers part of this, co-pays and deductibles cost $100–$600 monthly in out-of-pocket prescription costs alone.

Medical equipment like crutches, wheelchairs, orthopedic braces, and wound care supplies fall into this category. In Las Vegas, medical supply retailers and pharmacies charge approximately :

- $50–$150 for walking aids

- $300–$800 for custom braces

- Over $1,000 for wheelchairs or mobility support devices

4. Rehabilitation & Physical Therapy Expenses

Many accident victims require rehab and physical therapy to regain mobility and reduce long-term pain after discharge. Physical therapy sessions typically cost $90–$200 per session without insurance in Nevada. Long-term rehab easily totals $5,000 to $15,000. Local facilities offer bundled plans, but coverage gaps still leave patients with a financial burden during recovery.

5. Ongoing Treatment for Long-Term Injuries

Some injuries, like traumatic brain injury (TBI), spinal cord damage, or PTSD, require ongoing care. In Las Vegas, ongoing medical care for accident-related injuries costs anywhere from $500 to over $10,000 annually, depending on frequency, provider rates, and severity of the condition.

These expenses often do not surface in the immediate aftermath and come weeks or months later, but nevertheless are critical to include in legal claims to ensure full compensation.

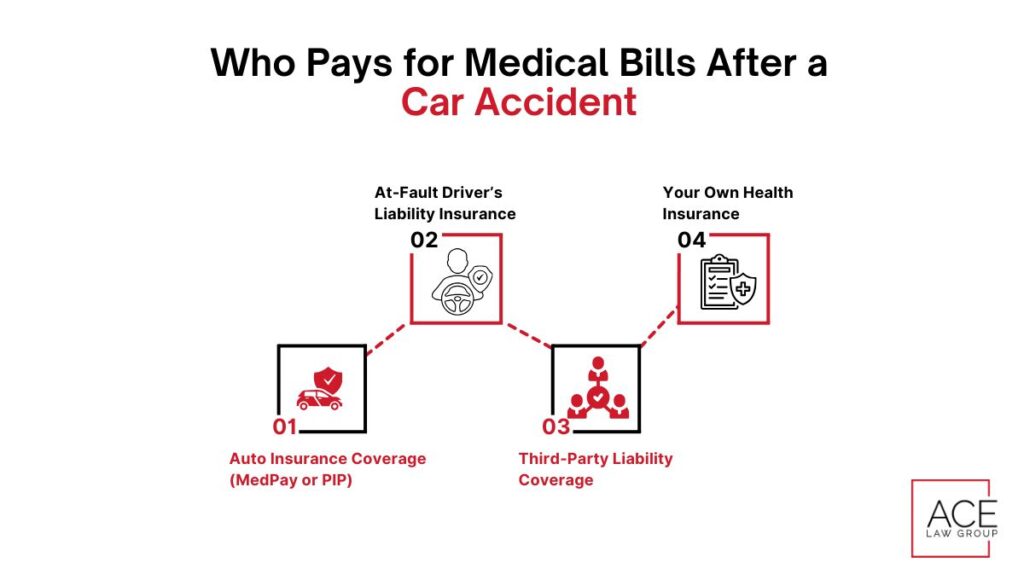

Who Pays for Medical Bills After a Car Accident in Las Vegas?

Medical bills after a car accident in Las Vegas are covered by multiple sources, depending on the insurance policies involved, the severity of injuries, and who is found at fault. Under Nevada law, multiple layers of coverage apply, but it’s not always clear who pays what or when.

Here is a detailed breakdown of the four main sources that pay for accident-related medical bills:

- Auto Insurance Coverage (MedPay or PIP)

- At-Fault Driver’s Liability Insurance

- Third-Party Liability Coverage (e.g., Uber, Lyft, or commercial policies)

- Your Own Health Insurance

You risk facing out-of-pocket expenses if your medical expenses exceed the limits of one policy, unless another layer of coverage applies.

When Does Auto Insurance Coverage Pay Medical Bills in Las Vegas?

Per Nevada regulations, auto insurance covers medical expenses through MedPay if included in your policy. MedPay pays regardless of fault, typically up to $5,000–$10,000. It kicks in immediately, helping bridge the gap while the fault is determined.

MedPay also covers ambulance transport, ER visits, dental treatment, co-pays, and deductibles. Since Nevada is an at-fault state, MedPay helps bridge the gap before the at-fault driver’s insurance settles, a process that could take weeks or months.

When Does an At-Fault Driver’s Insurance Pay Medical Bills in Las Vegas?

Whether a resident or an out-of-town visitor, the at-fault driver in Las Vegas is liable for paying for your medical expenses if they caused the crash. However, it typically pays out after a settlement or verdict is reached, which may take months or even years.

That delay means you must find short-term solutions like MedPay, health insurance, or a lien arrangement to handle costs upfront.

Nevada minimum liability coverage:

- $25,000 per person

- $50,000 per accident (bodily injury)

- $20,000 (property damage)

When Does Third-Party Liability Pay Medical Bills in Las Vegas?

A third party, like a vehicle owner, commercial company, or manufacturer, owes you compensation if they share blame for the car crash. Third-party liability cases involve more complex legal steps but often result in higher settlements due to layered and shared responsibility.

Third-party liability applies in cases involving:

- Commercial vehicles

- Ride-share drivers (Uber, Lyft)

- Company-owned cars

- Out-of-state drivers

For example, Uber and Lyft carry up to $1 million in liability coverage for active rides (when a passenger is onboard). However, claiming under these policies often requires legal proof that:

- The driver was at fault

- They were actively working during the accident

- Your injuries meet policy thresholds

When Does Your Health Insurance Pay Medical Bills in Las Vegas?

Your private health insurance (or Medicare/Medicaid) covers medical bills if no other coverage applies or while waiting on settlements. However, many health insurers file for reimbursement once the case is settled. This process is called subrogation.

Nevada law allows insurers to collect back what they paid out of pocket if their claim is won, which is why accurate expense tracking, along with accurate execution of legal processes, is critical.

How to File an Insurance Claim for Medical Expenses After a Car Accident in Las Vegas

Filing a successful medical expense claim in Clark County involves several legal and administrative steps. It’s vital to follow Nevada-specific protocols, use the right documentation, and protect yourself from insurance tactics that reduce your payout to improve your chances of full compensation.

Victims who hire a personal injury attorney in Las Vegas recover, on average, 3.5x more in medical-related damages than those who go it alone, according to recent state-level injury claim reports.

Here’s a five-step guide on how to get compensation for medical bills after a car accident in Las Vegas.

Step 1. Gather & Organize Medical Records

First, you must request ER records, diagnosis reports, treatment notes, and discharge instructions. Then, obtain itemized billing statements from hospitals, urgent care, specialists, and rehab providers, including receipts for out-of-pocket medical costs, like prescriptions and equipment.

Nevada insurers often require thorough, date-stamped medical documentation directly connecting each treatment to the accident. Las Vegas area hospitals like Sunrise and UMC provide records by request, but it takes 7-14 business days. Failing to organize complete documentation often delays or reduces your settlement.

Step 2. Notify Relevant Insurance Companies

Next, inform all relevant insurance providers about your accident. This includes your auto insurance company (especially if you carry Medical Payments Coverage), the at-fault driver’s insurance, and your health insurance provider if they are covering any care.

Under Nevada law, insurers typically expect notification within days of the crash. Delays result in claim complications or outright denials. When dealing with the at-fault party’s insurance, provide only basic facts, such as the date, location, and vehicle details, and avoid discussing fault or injuries in-depth.

Las Vegas-based insurance adjusters are trained to minimize payouts, so it is best to avoid giving recorded statements without first consulting an attorney. Insurers may attempt to claim a lack of timely notice and use it as grounds to reduce or deny your claim if you miss this step or delay it.

Step 3. Submit Required Documentation for Claims

Begin submitting all relevant documentation once you’ve notified insurers. The 5 types of documentation you must submit include:

- Your medical records and bills

- An accident report from the Las Vegas Metro Police or Nevada Highway Patrol

- Photos of injuries and vehicle damage

- Recent pay stubs if you are claiming lost wages

- Insurance claim forms (Each insurer has its own paperwork)

Las Vegas providers take 2–4 weeks to supply detailed records, so request them early. Always submit your documents via certified mail or secure digital portals to confirm delivery.

Nevada insurers are strict about documentation. If anything is missing, unclear, or does not link treatment to the accident, they can argue your care was not necessary or related to the crash, cutting your final payout amount significantly.

Step 4. Work with Insurance Adjusters

You will work with one or more insurance adjusters after filing your claim. The insurance adjusters’ role is to assess your claim, but their ultimate goal is to protect their company’s bottom line. In Las Vegas, adjusters commonly challenge four areas: the necessity of treatment, gaps in care, delays in seeking treatment, and costs of specific services.

Respond to all inquiries promptly and keep a record of every interaction. Be polite but cautious; do not downplay your injuries, speculate about recovery, or share unrelated medical history.

It is highly advisable to have a Las Vegas personal injury lawyer step in if negotiations become complex or the adjuster offers a lowball settlement. Attorneys present medical evidence and legal pressure that dissuades dubious insurer tactics and leads to a more accurate and higher valuation of your claim.

Step 5. Handle Claim Denials or Delays

Do not panic if your claim is denied or stalls out, but do not ignore it either. Nevada allows insurers to deny claims only with valid reasoning. Start by requesting a written explanation of the denial.

Four common reasons for claim denials include insufficient documentation, missed deadlines, disputed fault, and treatment gaps.

A skilled Las Vegas car accident attorney can intervene and challenge the insurer’s actions if your claim is denied in bad faith or if the delay becomes unreasonable. Nevada law even allows victims to sue insurers for acting in bad faith, potentially recovering additional compensation.

Missing this step or letting delays drag on severely impacts your final settlement and lets insurers off the hook.

How Medical Bills Influence Car Accident Settlement Negotiations in Las Vegas

Medical bills are often the largest component of a car accident settlement in Las Vegas. These expenses reflect the severity of your injuries and form the basis for calculating pain and suffering, future care needs, and overall damages.

Nevada follows an at-fault system, meaning the liable party’s insurance company is responsible for compensating you. However, insurance adjusters will not just take your word for it. They rely on hard evidence like itemized bills, treatment timelines, and hospital diagnostic codes to evaluate the legitimacy and value of your claim.

Accurately calculating and documenting your medical expenses is crucial. Any error, omission, or delay results in a lower settlement or outright denial. You cannot go back and claim additional expenses you “forgot” to include once a settlement is signed.

How Unpaid Medical Bills Affect Your Compensation

Unpaid medical bills demonstrate the real financial burden you have endured. But, they may be used by the defense to argue that your treatment was unnecessary, not urgent, or unrelated to the accident.

Hospitals and providers can file medical liens – legal claims against your future settlement – if you have racked up unpaid bills in Las Vegas. Without proper legal guidance, you could walk away with far less than expected, sometimes even owing money after the case is resolved.

It is critical to have your attorney notify providers that a claim is pending, negotiate lien terms, and ensure all current and future medical costs are clearly included in your demand in order to fully protect your compensation. Unpaid bills support your claim rather than shrink your recovery when managed proactively.

How Insurance Adjusters’ Calculations Affect Your Compensation

Insurance adjusters play a central role in determining how much compensation you receive after a car accident in Las Vegas. Adjusters’ calculations directly affect your payout because they decide how much of your medical treatment they believe is reasonable, necessary, and accident-related. Your total settlement drops significantly if they undervalue any part of your care.

Adjusters in Nevada often use software like Colossus to assign values to medical treatments, relying on algorithms rather than personal circumstances. This results in lower compensation, especially for non-superficial soft tissue injuries, delayed care, or non-surgical treatments. They also apply “medical multipliers” (usually 1.5 to 5x your medical costs) to estimate non-economic damages like pain and suffering if your documentation is clear, complete, and consistent.

Your attorney can challenge how insurance works in Las Vegas car accident claims by presenting expert medical opinions, correcting inaccurate assumptions, and highlighting gaps in the insurer’s valuation logic to protect your claim. The more strategic and thorough your documentation, the more difficult it becomes for insurers to downplay your compensation.

How a Lawyer’s Negotiation Affects Your Compensation

A lawyer’s negotiation directly increases the amount you receive in a car accident settlement. Experienced Las Vegas attorneys know how to justify every medical cost, project future treatment needs, and challenge lowball offers using legal precedent and medical evidence, unlike adjusters who aim to minimize payouts.

Insurance companies are far more likely to settle fairly and rapidly when they know a skilled attorney is prepared to take the case to court. Lawyers also negotiate down medical liens, ensuring that more of your settlement goes to you, not your healthcare providers. In Nevada, local trial attorneys who understand recent precedent actions of Clark County juries can leverage that insight to secure stronger settlement outcomes.

How Can Ace Law Group Help Recover Medical Expenses After a Car Accident in Las Vegas

Ace Law Group can help injured victims in Las Vegas recover medical expenses by holding insurance companies accountable and ensuring that every treatment cost-past, present, and future is fully documented, negotiated, and compensated.

Additionally, our Las Vegas car accident lawyers help negotiate down medical liens, so more of your final settlement goes to you and not your providers. We ensure that insurers do not overlook or undervalue your care by building a strong, evidence-backed demand. Our firm delivers proven results that often exceed what victims achieve alone, with decades of combined experience among our legal team and deep familiarity with Clark County courts.

Don’t wait if you’re struggling with medical bills after a crash. Call us anytime at (702) 570-9179 for a free consultation. No fees unless we win – you don’t pay until we recover for you.